On Good Morning America, Joe the Plumber said that it was unfair for someone to have to pay more just because they make more. He called it “socialist,” as do many conservatives. John McCain objected to this spreading the wealth around as being “class warfare.”

On Good Morning America, Joe the Plumber said that it was unfair for someone to have to pay more just because they make more. He called it “socialist,” as do many conservatives. John McCain objected to this spreading the wealth around as being “class warfare.”

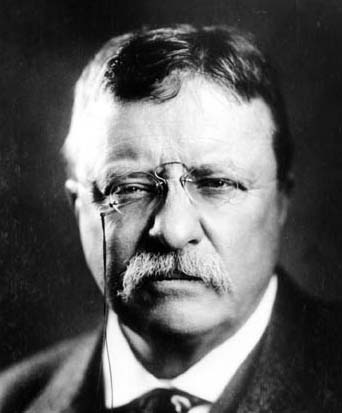

How did this socialist germ — the idea that wealthier people should pay higher taxes — creep into the American bloodstream? Through John McCain’s hero, Theodore Roosevelt. He championed the idea that the rich should not only pay more money but a higher rate, arguing explicitly that it contradicted the spirit of socialism.

Speaking about a progressive inheritance tax, Roosevelt said;

“A heavy progressive tax upon a very large fortune is in no way such a tax upon thrift or industry as a like would be on a small fortune. No advantage comes either to the country as a whole or to the individuals inheriting the money by permitting the transmission in their entirety of the enormous fortunes which would be affected by such a tax; and as an incident to its function of revenue raising, such a tax would help to preserve a measurable equality of opportunity for the people of the generations growing to manhood.

“We have not the slightest sympathy with that socialistic idea which would try to put laziness, thriftlessness and inefficiency on a par with industry, thrift and efficiency; which would strive to break up not merely private property, but what is far more important, the home, the chief prop upon which our whole civilization stands. Such a theory, if ever adopted, would mean the ruin of the entire country–a ruin which would bear heaviest upon the weakest, upon those least able to shift for themselves.

“But proposals for legislation such as this herein advocated are directly opposed to this class of socialistic theories. Our aim is to recognize what Lincoln pointed out: The fact that there are some respects in which men are obviously not equal; but also to insist that there should be an equality of self-respect and of mutual respect, an equality of rights before the law, and at least an approximate equality in the conditions under which each man obtains the chance to show the stuff that is in him when compared to his fellows.”

Roosevelt later also endorsed a progressive income tax:

“At many stages in the advance of humanity, this conflict between the men who possess more than they have earned and the men who have earned more than they possess is the central condition of progress. In our day it appears as the struggle of freemen to gain and hold the right of self-government as against the special interests, who twist the methods of free government into machinery for defeating the popular will. At every stage, and under all circumstances, the essence of the struggle is to equalize opportunity, destroy privilege, and give to the life and citizenship of every individual the highest possible value both to himself and to the commonwealth……

“No man should receive a dollar unless that dollar has been fairly earned. Every dollar received should represent a dollar?s worth of service rendered?not gambling in stocks, but service rendered. The really big fortune, the swollen fortune, by the mere fact of its size, acquires qualities which differentiate it in kind as well as in degree from what is possessed by men of relatively small means. Therefore, I believe in a graduated income tax on big fortunes, and in another tax which is far more easily collected and far more effective, a graduated inheritance tax on big fortunes, properly safeguarded against evasion, and increasing rapidly in amount with the size of the estate.”